orange county ca sales tax

Orange County has one of the highest median property taxes in the United States and is ranked 119th of the 3143 counties in order of median property taxes. The latest sales tax rate for Orange CA.

Orange County Real Estate Market Report And Trends

The California state sales tax rate is currently 6.

. This rate includes any state county city and local sales taxes. Review and pay your property taxes online by eCheck using your bank account no cost or a credit card 229 convenience fee with a minimum charge of 195. For example imagine you are purchasing a vehicle for 20000 with the state sales tax of 725.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. The statewide tax rate is 725. The minimum is 725.

Orange County Property Records are real estate documents that contain information related to real property in Orange County California. The Orange County sales tax rate is 025. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

The combined sales tax rate imposed by the State and the County presently stands at 775. There are a total of 474 local tax jurisdictions across the state collecting an average local tax of 2617. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Orange County CA at tax lien auctions or online distressed asset sales.

The median property tax in Orange County California is 3404 per year for a home worth the median value of 607900. Orange CA CTEC Practice for Sale. Orange County collects an additional 050 which brings the Orange County sales tax 50 higher than the state minimum sales tax of 725.

Search for your property information by entering your parcel number property address tax lien number or watercraftaircraft registration number. 1503 rows Lowest sales tax NA Highest sales tax 1075 California Sales Tax. 2020 rates included for use while preparing your income tax deduction.

These buyers bid for an interest rate on the taxes owed and the right to collect. California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35. The base state sales tax rate in California is 6.

For Secured or Supplemental Property Tax Bills SEARCH BY. 1450 is how much you would need to pay in sales tax for the vehicle regardless of if it was used purchased with. Sellers are required to report and pay the applicable district taxes for their taxable.

Orange County collects on average 056 of a propertys assessed fair market value as property tax. The advertising and collection cost is added to the delinquent bill. If this rate has been updated locally please contact us and we will update the sales.

Those district tax rates range from 010 to 100. California has a 6 sales tax and Orange County collects an additional 025 so the minimum sales tax rate in Orange County is 625 not including any city or special district taxes. When a certificate is sold against a piece.

Orange County also assesses a sales tax for some items including a standard rate of a quarter of a percent and a special tax rate of 15. Chairman Doug Chaffee presented the proclamation at Tuesdays Board meeting to Treasurer Shari L. Local tax rates in California range from 015 to 3 making the sales tax range in California 725 to 1025.

82 rows The total sales tax rate in any given location can be broken down into state county city and special district rates. The 2018 United States Supreme Court decision in. On or before June 1 the Tax Collector must conduct a Tax Certificate Sale of the unpaid taxes on each parcel of property.

1788 rows California City County Sales Use Tax Rates effective April 1. The December 2020 total local sales tax rate was also 7750. The mandatory local rate is 125 which makes the total minimum combined sales tax rate 725.

The State of California currently charges a sales tax rate of 6. The Orange County California sales tax is 775 consisting of 600 California state sales tax and 175 Orange County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc. 20000 X 0725 1450.

Orange County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Orange County totaling 025. The County of Orange has proclaimed April as National Financial Literacy Month to improve the financial literacy of the public. The Orange County Sales Tax is collected by the merchant on all qualifying sales made.

Orange is in the following zip codes. The sales tax rate for Orange County was updated for the 2020 tax year this is the current sales tax rate we are using in the Orange County California Sales Tax Comparison Calculator for 202223. Multiply the vehicle price before trade-in or incentives by the sales tax fee.

Find Orange County Property Records. Parcel Number APN or. Average Sales Tax With Local.

The minimum combined 2022 sales tax rate for Orange County California is 775. Here is the breakdown of the of 725 minimum CA sales tax. Orange County CA currently has 2703 tax liens available as of April 28.

PayReviewPrint Property Tax Bill Related Information. The state of California keeps 600 of the sales tax collected and the additional 125 goes to the county 1 and city 25 funds. This is the total of state and county sales tax rates.

The current total local sales tax rate in Orange County CA is 7750. Sales tax in Orange County California is currently 775. April 15 2022.

Orange CA is in Orange County. Orange County Sales Tax Rates for 2022. For Unsecured Property Tax Bills SEARCH BY.

Some areas may have more than one district tax in effect. This table shows the total sales tax rates for all cities and towns in Orange. Freidenrich who is leading the education efforts for.

Please CLICK on the FIND button after keying in information in the SEARCH Box for Property Information. The owner is a Public AccountantCTEC This practice was established in 2016 Software in use includes Lacerte Approximately 61 bookkeeping clients generating 132747 in revenue Approximately 442 individual tax returns with an average fee of 310 per return Approximately 101. The sale is operated on a competitive bid basis with interest bids beginning at 18 and progressing downward.

Some California municipalities also possess the. You can find more tax rates and allowances for Orange County and California in the 2022 California Tax Tables.

California Sales Tax Rates By City County 2022

Who Pays The Transfer Tax In Orange County California

Historical California Tax Policy Information Ballotpedia

California Sales Tax Small Business Guide Truic

California Taxpayers Association California Tax Facts

California Sales Tax Rates Vary By City And County Econtax Blog

Understanding California S Sales Tax

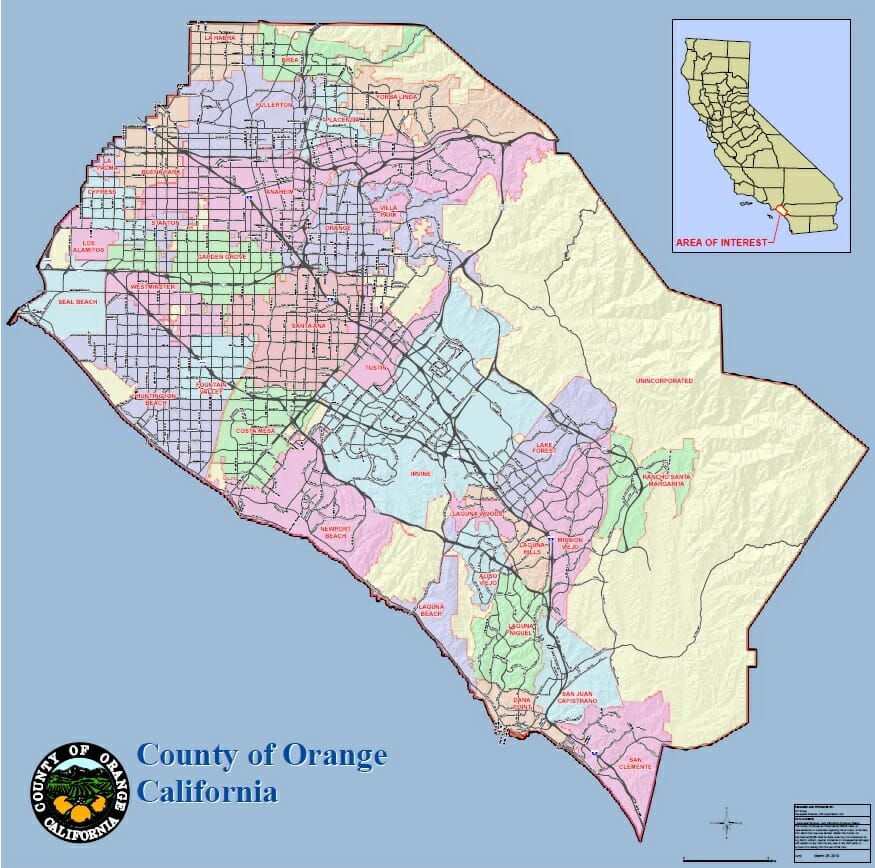

Orange County California Map Bing Images Beach Vacation Rentals Orange County California Real Estate

Food And Sales Tax 2020 In California Heather

Food And Sales Tax 2020 In California Heather

Sales Tax In Orange County Enjoy Oc

Who Pays The Transfer Tax In Orange County California

Understanding California S Sales Tax

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Orange County Property Tax Oc Tax Collector Tax Specialists